advantages and disadvantages of llc for rental property

Some examples of these benefits include. Ad The only OH business license service that includes both a free EIN operating agreement.

National Register Of Historic Places Listings In Mercer County New Jersey New Orleans Homes Holiday House Tours House

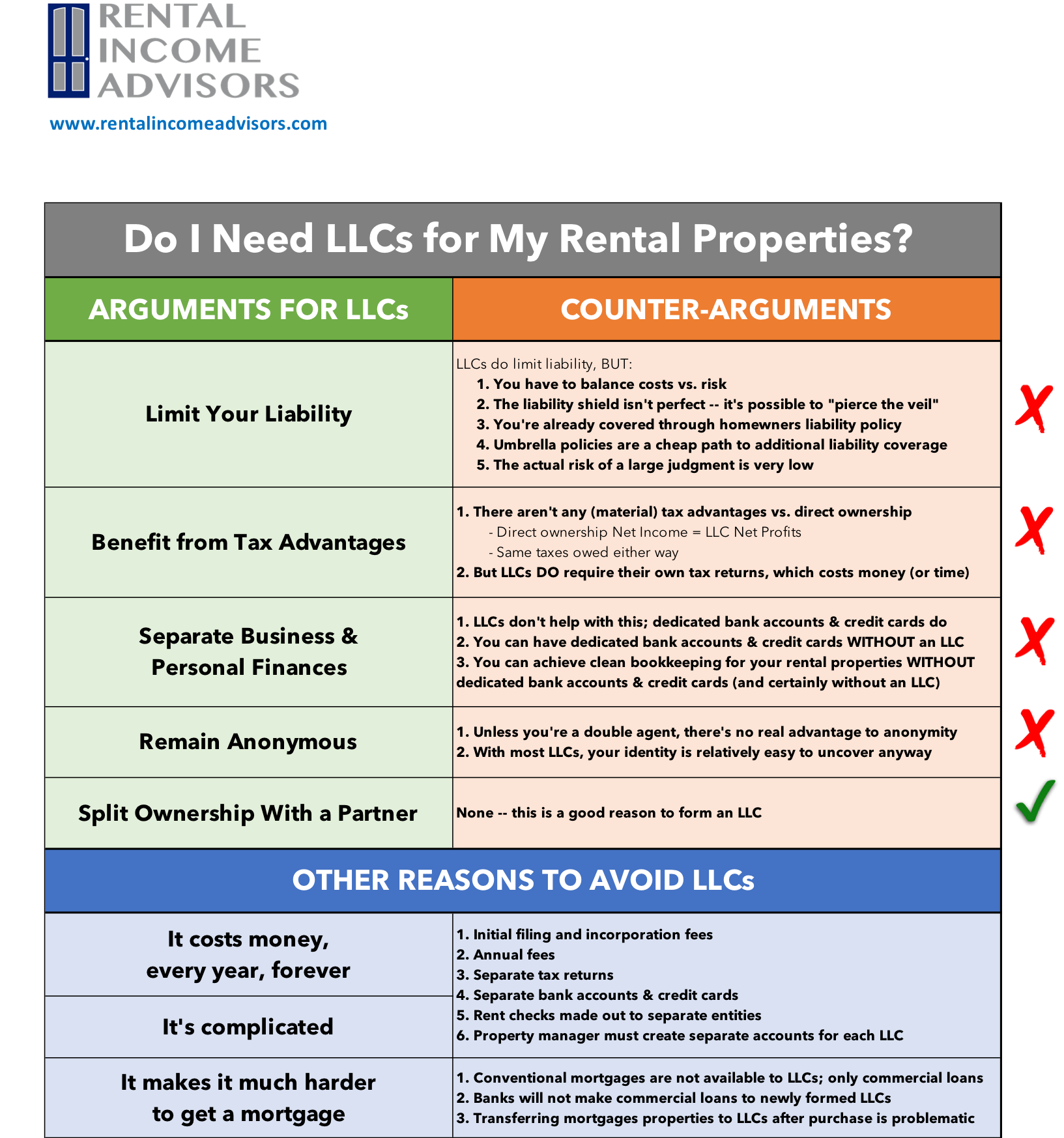

The Advantages and Disadvantages of titling your Rental Properties into an LLC.

. Some of these benefits include. Using a limited liability company for a rental property business is a great way to protect your liability get tax benefits and gain other. Yes you may have liability insurance.

Rental property LLCs offer many benefits which is why LLCs are so popular in most states. Speaking of cost the process of forming an LLC can be fairly expensive. In the state of Texas the cost of filing for a Texas LLC certificate of formation is currently 300.

Even with the above advantages to using an LLC for single family rental properties no solution is completely. Get Privacy by Default superior customer service from Corporate Guides LLC docs more. Using a limited liability company.

The main benefits of LLC for rental property are being able to limit your. See How Easily You Can File an LLC in Your Desired State With These LLC Formation Services. If you operate rental properties with only liability insurance and do not form a business your.

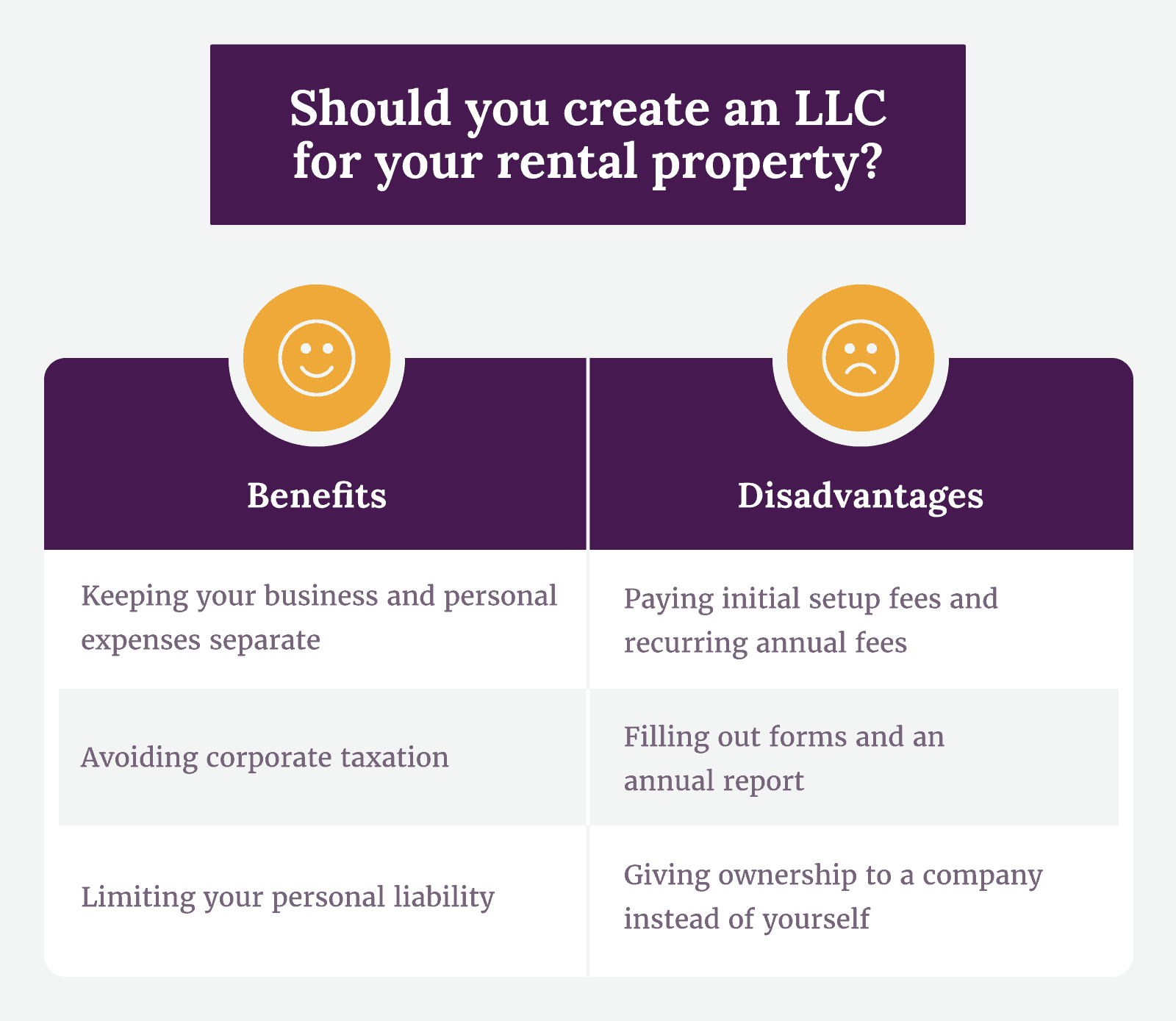

Holding rental property in an LLC also provides some options and flexibility when it comes time to pay taxes. Pass-through tax advantages. An intangible benefit of owning and holding real estate in the name of an LLC is that it appears to the public to be more professional especially.

Ad Compare the Best LLC Formation Services In All States and Let the Experts Do The Paperwork. An LLC is a US business structure that combines the limited liability protection of a corporation with the simplicity and pass-through taxation of a sole proprietorship. Basic Advantages of Using an LLC for a Rental Property.

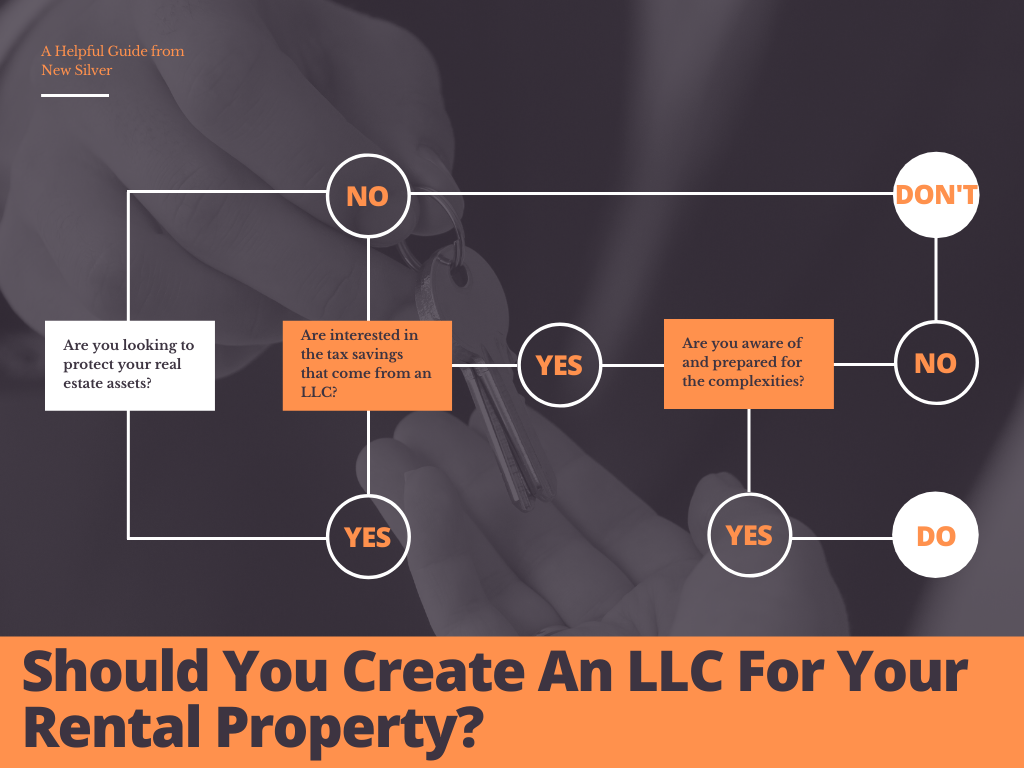

Rental properties can be financially rewarding and have numerous tax benefits including the ability to deduct insurance the interest on your mortgage and maintenance. There are 6 key advantages and disadvantages of creating an LLC for a rental or Airbnb property. Pros of an LLC for rental property.

Depending on your specific situation and unique circumstances the following may be. Learn more about them and all alternatives. Owning a rental property under your rental business LLC allows you to limit your legal liability and protects your.

The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. This means that a real estate LLC can have its own bank account have its own tax ID number and conduct real estate investing business all under its own name. Tax Benefits of an LLC.

Three Cons of Using an LLC for Single Family Rental Properties. The main reason investors prefer to have their rental properties in an LLC is for. Pros of an LLC.

As stated above the main benefit of forming an LLC is personal liability protection. Opening a real estate LLC requires you to do three things. Benefits of Creating an LLC.

Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. Payment is not restricted to the owners of the LLC. Profits subject to social security and medicare taxes.

The IRS allows LLCs to elect how they would like to. There are many advantages to establishing an LLC for your rental properties. Ad The only OH business license service that includes both a free EIN operating agreement.

Get Privacy by Default superior customer service from Corporate Guides LLC docs more. Keep the property in good repair which protects you and your business from being found negligent should. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company.

Our Business Specialists Help You Incorporate Your Business. In some circumstances owners of an LLC may end up paying more taxes than owners of a corporation. Ad Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets.

Liability Benefits of LLCs.

If You Are Looking For Furnished Or Unfurnished Rental Homes In Harker Heights Tx Consider John Reider Proper Real Estate Buying Real Estate Home Buying Tips

Confluence C 3 By Ideabox Llc Salem Oregon Pnw Prefab Modular Manufacturedhome Green Eco Ecofriendl Prefab Cabins Modern Prefab Homes Colorado Homes

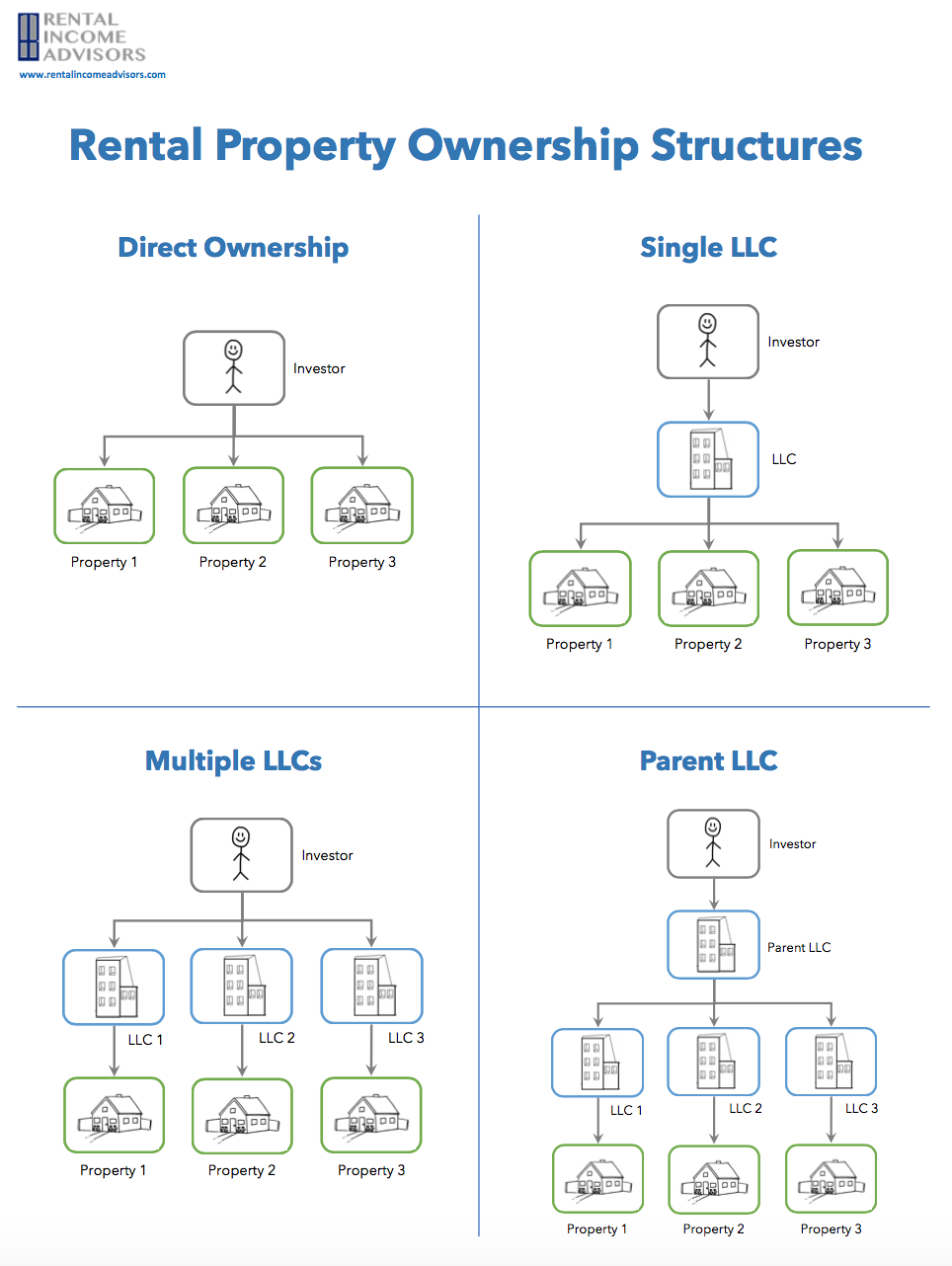

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

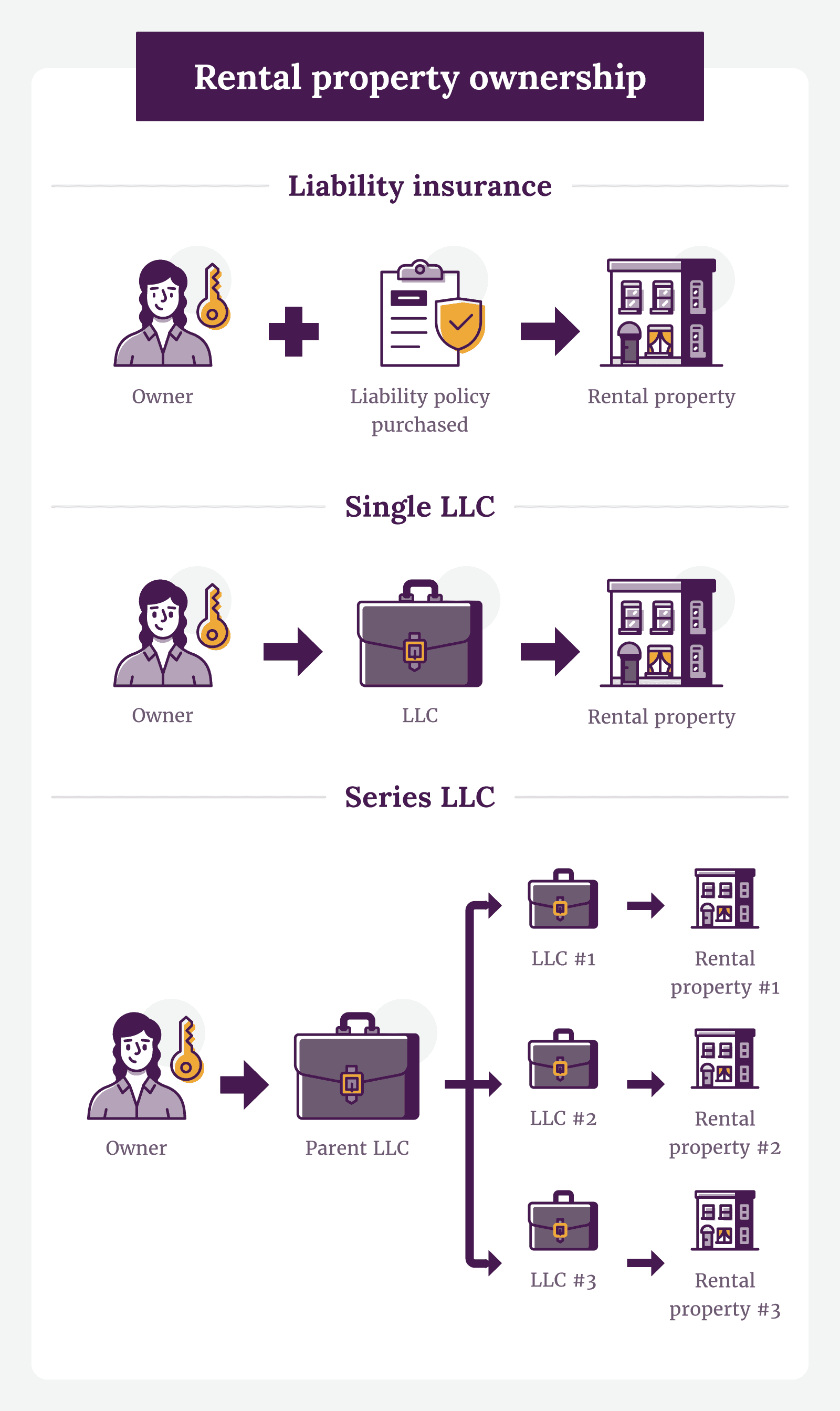

Should You Create An Llc For Rental Property Pros And Cons New Silver

Llc For Rental Property Pros Cons Explained Simplifyllc

Haven Model By Ideabox Llc Prefab Homes Salem Or Modular Manufactured Modern Prefab Homes Small Space Living Prefab Homes

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

How To File Your Freelance Taxes And Save Money Saving Money Financial Tips Small Business Accounting

Llc For Rental Property What Should Real Estate Investors Do

Pros Cons Of Using An Llc For Rental Property W Matt Faircloth For Biggerpockets Youtube

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

How I Launched My Real Estate Investing Career With 5 000 Passive Income M D Property Investor Real Estate Investing Home Loans

Watching All Of The Agents In Our Exp Network That Are Tagging New Agents Joining Our Exp Family In This Movement Paradigm Shift Paradigm Real Estate Articles

How To Use Depreciation To Keep More Money In Your Pocket Money Estate Tax Rental Property Investment

General Partnership Agreement Pdf General Partnership Contract Template Agreement

6 Ton Tandem Axle Gooseneck Deckover Dovetail Bg0621de In 2022 Gooseneck Trailer Dovetail Trailer Gooseneck

Llc For Rental Property Pros Cons Explained Simplifyllc

20 Pros And Cons Of Creating An Llc For Your Rental Property